Andrew Ang《Asset Management: A Systematic Approach to Factor Investing》

书刊介绍

内容简介

Stocks and bonds? Real estate? Hedge funds? Private equity? If you think those are the things to focus on in building an investment portfolio, Andrew Ang has accumulated a body of research that will prove otherwise.

In his new book Asset Management: A Systematic Approach to Factor Investing, Ang upends the conventional wisdom about asset allocation by showing that what matters aren't asset class labels but the bundles of overlapping risks they represent. Making investments is like eating a healthy diet, Ang says: you've got to look through the foods you eat to focus on the nutrients they contain. Failing to do so can lead to a serious case of malnutrition-for investors as well as diners.

The key, in Ang's view, is bad times, and the fact that every investor's bad times are somewhat different. The notion that bad times are paramount is the guiding principle of the book, which offers a new approach to the age-old problem of where do you put your money? Years of experience, both as a finance professor and as a consultant, have led Ang to see that the traditional approach, with its focus on asset classes, is too crude and ultimately too costly to serve investors adequately. He focuses instead on "factor risks," the peculiar sets of hard times that cut across asset classes, and that must be the focus of our attention if we are to weather market turmoil and receive the rewards that come with doing so. Optimally harvesting factor premiums-on our own or by hiring others-requires identifying your particular set of hard times, and exploiting the difference between them and those of the average investor.

Clearly written yet chock-full of the latest research and data, Asset Management will be indispensable reading for trustees, professional money managers, smart private investors, and business students who want to understand the economics behind factor risk premiums, harvest them efficiently in their portfolios, and embark on the search for true alpha.

相关推荐

-

国宝:瓷器

国宝:瓷器 本书特色 ★ 入选文物都是从全国各地博物馆、文物考古研究所等单位收藏的,被定为一级品以上的文物中精选★ 注重选择极具代表性的文物,涵盖了各朝代、各地...

-

韦恩·玛格尔《犹太人智慧大全集》

犹太人是世界上命运最悲惨的民族,2000多年以来,他们一直是世界的流浪汉;他们没有国家,饱受各国反犹主义的歧视与凌辱;然而磨

-

陌上三秋《白领的投资理财日记》

《白领的投资理财日记》内容简介:有钱了以后怎么办?努力赚钱,更要努力管理赚回来的钱!《白领的投资理财日记》就是一本专为“

-

ETF全球投资指南

"王延巍互联网从业者,在早期职业生涯中伴随公司在美上市,开始接触美股,成为美股和投资爱好者,以“美股基金策略”为笔名长期在公众号、投资社区分享自己的投资经验。凭...

-

华投《看盘方法与技巧大全》

《看盘方法与技巧大全(超值白金版)》由浅入深地讲解了看盘过程中的方方面面,在篇章的结构安排上,既遵循了由易到难的学习过程,

-

刘健伟|沈良《期货英雄4》

通过东航金控有限公司举办的蓝海密剑期货实盘大赛,中国期货市场每年都会涌现出一批投资英雄,不管这些大赛优秀选手是否能一直笑

-

刘超|周晓烨《炒股必知必读》

本书内容包括股市攫金——快速致富新途径、踏进股市第一步——了解股份公司和股票、股场如战场——明明白白看股股票市场、万事开

-

于文红《实现梦想的艺术》

关于《实现梦想的艺术》,原本其中的部分内容是用来作为内部员工培训时的一些经验。在教学时,我会帮助员工做目标设定的梦想板。

-

![[美] 保罗·皮尔泽《财富革命》](http://oss.shudanhao.com/caiji/chazidian/2023/6969.jpg)

[美] 保罗·皮尔泽《财富革命》

本书作者曾任布什和克林顿两届总统顾问,25岁即担任花旗银行副总裁,是美国著名的经济学家。本书是最这迄今为止最著名的著作。全

-

道氏理论-顶级交易员深入解读

道氏理论-顶级交易员深入解读 本书特色 道氏理论是从经验和数据中逐步发展起来的,历经了查尔斯.H.道——汉米尔顿—&mdas...

-

在线鉴定:卯

在线鉴定:卯 内容简介 本书适合人群:误以为收藏是有钱人游戏的自甘平庸的人士;花了不少银子,置办了成堆的坛坛罐罐的收藏菜鸟;每天盯着那些秘不示人的宝贝发呆的寂寞...

-

大众理财实战宝典-(第二辑)

大众理财实战宝典-(第二辑) 内容简介 本书按理财领域分为9章,各章以独立文章的形式分别从银行、外汇、债券、股票、基金、保险、税收筹划、房产、汽车、集藏方面介绍...

-

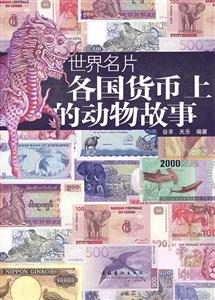

世界名片-各国货币上的动物故事

世界名片-各国货币上的动物故事 内容简介 一个国家的货币就是一张世界名片。 上了“名片”的动物大都不是一般的动物,它们有的是国宝,有的是宠物、有的是“活化石”;...

-

钱币-古玩指南:钱币

钱币-古玩指南 本书特色 本书古玩业内必读文献,首部系统理论著述。六十年来不断被解读的经典,在书画和器物的源流枝蔓中品味传统文化的氤氲气息。收藏爱好者入门时,它...

-

一看就懂!股神巴菲特的投资策略-超强版

一看就懂!股神巴菲特的投资策略-超强版 本书特色 **本全彩实用图解书,解析巴菲特不一样的理财哲学全彩图说,丰富表格想知道巴菲特能不能续写传奇?超强版《股神巴菲...

-

彭冬初《证券交易之道》

《证券交易之道:一个证券职业交易者的必由之路》主要内容:股道即天道,遵循自然法则;股道即人道,暗合做人准则。得两道者何其少

-

债券投资实战

目前市面上关于债券投资的书籍主要分两种。一种偏向于债券基础理论,如布鲁斯·塔克曼等著的《固定收益证券》或弗兰克 J. 法博齐编著的《固定收益证券手册》,此类书籍...

-

想成财女,要趁早!

想成财女,要趁早! 本书特色 本书:女人理财不是因为爱钱,而是为了得到幸福,女人千万要有钱,别浪费时间活在别人的生活里,欢迎你加入超级rich的财女俱乐部,6大...

-

严行方《股圣彼得·林奇投资圣经》

《股圣彼得•林奇投资圣经》内容简介为:彼得•林奇和全球首富沃伦•巴菲特两人惺惺相惜。彼得•林奇的特点是,他管理的是一家基金,

-

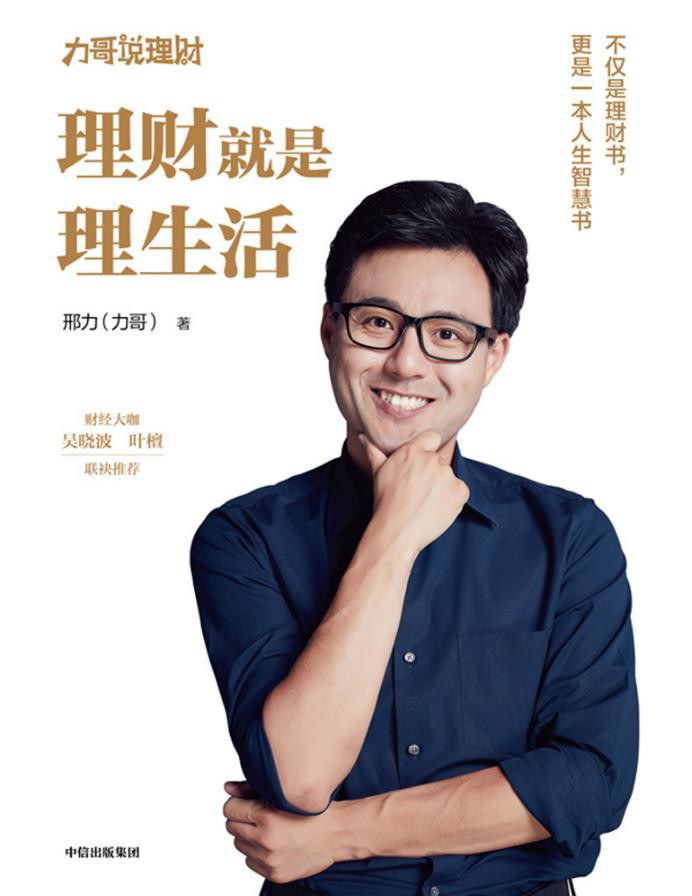

理财就是理生活

邢力(力哥)中国首档娱乐理财脱口秀节目《力哥说理财》创始人, 80后互联网理财红人,持证国家理财规划师,自创 “基金七步定投策略”。曾任《理财周刊》金融研究中心...