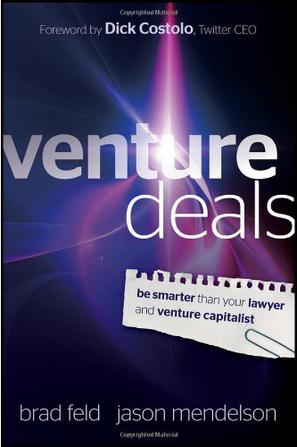

《Venture Deals》书籍《Venture Deals》

书刊介绍

内容简介

An engaging guide to excelling in today's venture capital arena Beginning in 2005, Brad Feld and Jason Mendelson, managing directors at Foundry Group, wrote a long series of blog posts describing all the parts of a typical venture capital Term Sheet: a document which outlines key financial and other terms of a proposed investment. Since this time, they've seen the series used as the basis for a number of college courses, and have been thanked by thousands of people who have used the information to gain a better understanding of the venture capital field. Drawn from the past work Feld and Mendelson have written about in their blog and augmented with newer material, Venture Capital Financings puts this discipline in perspective and lays out the strategies that allow entrepreneurs to excel in their start-up companies. Page by page, this book discusses all facets of the venture capital fundraising process. Along the way, Feld and Mendelson touch on everything from how valuations are set to what externalities venture capitalists face that factor into entrepreneurs' businesses. Includes a breakdown analysis of the mechanics of a Term Sheet and the tactics needed to negotiate Details the different stages of the venture capital process, from starting a venture and seeing it through to the later stages Explores the entire venture capital ecosystem including those who invest in venture capitalist Contain standard documents that are used in these transactions Written by two highly regarded experts in the world of venture capital The venture capital arena is a complex and competitive place, but with this book as your guide, you'll discover what it takes to make your way through it.

Q&A with Co-Authors Brad Feld and Jason Mendelson

Co-Author Jason Mendelson I understand that VCs have primarily four functions they perform: raising funds, screening and investing in new businesses, managing current portfolio companies and some level of investor relations and internal operations. How do you divide your work day?

One of the great things about this job is that there is no “standard day.” Every day is different and the division of time reflects that. It's really hard to say what a typical day is like. Even typical weeks are hard to describe. It all depends on a particular partner's portfolio is doing and what their role is in the firm.

Some partners have operational responsibilities internal to the firm itself, some don't. In short, you could ask 100 VCs this answer and have 100 different answers. If you forced me to put some percentages on the table, I'd say a normal yearly time allocation (assuming that fundraising is not happening) might look something like this:

Screening, Analysis and Execution: 45%

Current Company monitoring: 45%

Investor Relations / Operations / Other: 10%

With a number of great companies being born of ideas coming from a youthful group of entrepreneurs, what advice do you have for the young person seeking to build a team of "time-tested, battle-hardened" professionals?

We think young-entrepreneurs are great. In fact, we like spending time with the younger set so much that we are active mentors and investors with Techstars. And certainly with our fund, we wouldn't hesitate to fund a first-time entrepreneur with a great idea.

Co-Author Brad Feld

I think the key to being a young entrepreneur is being self aware. Know what you know and also know what you don't. If you can communicate to a prospective investor that you are smart, have a great idea AND are emotionally intelligent and realize what other skills sets you'll need to surround yourself with, then I don't think being young and / or inexperienced will hurt your chances. In fact, youthful exuberance is infectious and sometimes younger folks will think outside the box more often than older ones who are set in their ways.

Are you aware of any VCs that have funded founders that have failed at their previous ventures?

Absolutely. Me! And many other VCs. Failure is a normal part of entrepreneurship which I've written about extensively in my blog.

My favorite entrepreneurs to fund are those that have had at least one success and one failure. While it is a cliche, failure teaches the big lessons. Most importantly, entrepreneurs that have some failure under their belt have humility and perspective that I think is deeply useful in the creation of the company.

There is a perspective – promoted by some people – that the best serial entrepreneurs have never been unsuccessful. This is a myth – the vast majority of successful entrepreneurs who I know have a long string of failures in their past.

Why don't VCs invest in real estate?

We don’t invest in real estate because we don’t know what we are doing in that market. Okay, that was a little glib, but it’s true. VCs don’t / shouldn’t invest in sectors and themes that they don’t understand. Outside of some folks that I know who made some shrewd residential moves with their personal properties, I’d not want to trust my money to a VC doing a pure-play real estate deal.

相关推荐

-

Victor Niederhoffer《投机客养成教育》

成功的交易人是有異於常人的族群,他們的財富不是只靠出色的操作系統和掌握技術指標的能力建立起來的。他們一天廿四小時迅速縱橫

-

一本书读懂股市指标

一本书读懂股市指标 本书特色 迈克尔·辛希瑞所著的《一本书读懂股市指标》之所以独一无二,是由于它有一半的内容帮助你学会运用指标,而另一半的内容会带领你直接进入那...

-

谭笑《骗人的保险,保险不骗人》

《骗人的保险保险不骗人》内容简介:所谓保险骗人,实际还是人骗人,保险本身并不骗人。要想保险不骗人,关键是你要懂保险。所以

-

一扔就涨《股剩是怎样炼成的》

这是一本超级搞笑的书。有人把它当成一篇篇幽默的炒股日记在看,然后捧腹大笑;有人却认为这是一位股票投资大师在婉转指点芸芸众

-

李壬杰《索罗斯的传奇人生》

《索罗斯的传奇人生》内容简介:在当今国际投资者的圈子里,如果说有什么人是非提不可的话,那么他就是乔治·索罗斯。在对投资问

-

《费雪论创富》书籍《费雪论创富》

得知《费雪论创富》被翻译成中文出版,我感到很惊喜。我们都亲眼见证了中国自20世纪90年代开始一直持续至今的经济腾飞,邓小平领

-

鉴宝大众收藏4-古典家具收藏三百问

鉴宝大众收藏4-古典家具收藏三百问 本书特色 与收藏热中的“高端”收藏相比,“大众”收藏正日益活跃。做为一种爱好和投资保值的需要,越来越多的人在渴望得到专家指导...

-

《女性理财从入门到精通》书籍《女性理财从入门到精通》

博多·舍费尔,1960年9月10日出生在德国科隆,是德国著名的投资家、企业家、演说家及畅销书作家。从小,博多便目睹了贫穷给人们带

-

中国工笔画与写意画精品鉴赏

中国工笔画与写意画精品鉴赏 内容简介 由于中国书画同源以及两者在达意抒情上都与骨法用笔、线条运行有紧密的联系,因此中国画同书法、篆刻相互影响,形成了显著而独特的...

-

波浪理论

波浪理论 本书特色 《波浪理论》:波浪理论基本信条,神奇数字与波浪理论,背驰讯号不容忽视,浪顶全身而退浪底伺机入货。波浪理论 内容简介 《波浪理论》内容简介:1...

-

![[美] 约翰·凯恩《高级波段交易》](http://oss.shudanhao.com/caiji/chazidian/2023/6064.jpg)

[美] 约翰·凯恩《高级波段交易》

约翰.凯恩(JohnCrane),是活跃于市场交易几十年的资深交易员。他是“交易员网络”(TradersNetwork)的创办和拥有者之一。“交

-

OpenCV3编程入门

《OpenCV3编程入门》内容简介:OpenCV在计算机视觉领域扮演着重要的角色。作为一个基于开源发行的跨平台计算机视觉库,OpenCV实现了

-

投资银行、对冲基金和私募股权投资

作者戴维•斯托厄尔教授,作为投资银行家在高盛、摩根大通和瑞银工作了20余年,担任过高盛的企业融资部副总裁,摩根大通和瑞银的董事总经理以及对冲基金负责权益衍生品的...

-

聂卫平围棋道场少儿围棋启蒙绘本(3~6岁)(共6册)

《聂卫平围棋道场少儿围棋启蒙绘本(3~6岁)(共6册)》内容简介:3~6岁是儿童发展想象力、记忆力、判断力和计算力的重要时期,也

-

王坤《股票投资入门与实战技巧》

《股票投资入门与实战技巧:从零开始学炒股》真正的零基础起步,分别介绍了股票基础知识、如何开户和运用炒股软件、股票常见术语

-

懒人赚大钱:每三个月操作一次的简单投资方法

懒人赚大钱:每三个月操作一次的简单投资方法 本书特色 《懒人赚大钱:每三个月操作一次的简单投资方法》:MACD之父*新力作。懒人赚大钱:每三个月操作一次的简单投...

-

博智《打败庄家》

如果您从来不赌,您完全可以不看本书。赌博很简单,只有输赢两种结果,赌博很复杂,很多人想尽各种方法要在赌场赢钱……如果神秘

-

《风投的选择》书籍《风投的选择》

本书作者采访了投资界最杰出的风险投资人,如RoelofBotha、MikeMaples、RandyKomisar等,讲述了他们发现前途无量的市场、产品和创

-

投资先投心

投资先投心 本书特色 投资不仅需要知识和技巧,更需要良好的心态和习惯,资深职业投资人与你分享投资的心得与奥秘对于大部分人来说,这本书里的故事和道理比巴菲特的经历...

-

笑傲牛熊

笑傲牛熊 本书特色 华尔街交易大师史丹温斯坦在本书中将复杂的技术分析简化为简单易行的操作系统,独创了阶段分析法。他将股价走势划分为四个阶段,指导读者在*简单的均...